- mine bitcoin on cell phone.

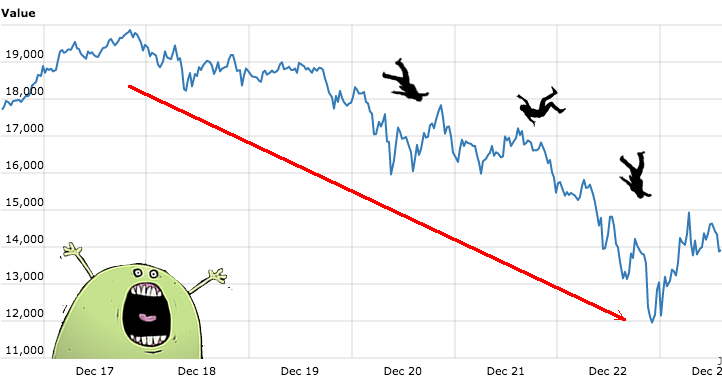

- Bitcoin Prices Crash After Liquidation of $1.5billion Worth of Derivative Contracts.

- Bitcoin crashing. Moves down over $10,000 on the day!

- como funciona o mercado de bitcoins.

Collateralized debt obligations further spread the leverage contagion across the world. At the height of the crisis, Citigroup Inc. In contrast, bitcoin is yet to overcome its renegade status within the financial services ecosystem. The increase in its prices has occurred within the confines of unregulated exchanges that are yet to pass scrutiny by regulatory agencies. Based on recent reports, the main players in these exchanges are individual investors and bots. Big banks and investment firms have largely stayed away from the bitcoin craze and their exposure to cryptocurrency markets, if any, is limited.

Down over $10,000 as longs liquidate as tech levels are broken/Yellen

While it is true that bitcoin-related stocks have risen in valuation, their numbers are low. But the collapse in tulip prices had a limited effect on the overall Dutch economy because serious financiers stayed away. According to Dutch historian Nicolaas Posthumus, only casual traders participated in bidding up prices for tulips for greed and profits. In the end, it was these people who were affected when prices collapsed. Similarly, a crash in bitcoin prices will trigger a sell-off and affect a very small number of people.

But that estimate betrays an incorrect understanding of the utility and markets to cryptocurrencies. There is already substantial investment in blockchain, the technology underlying bitcoin. Cryptocurrencies are also useful as a means of exchanging value within closed ecosystems. That said, it will be some time before their utility is realized within mainstream applications.

It is quite likely that a bitcoin price crash will result in a correction in their prices as well. It is also certain that the vast majority of cryptocurrencies that populate the current listings will disappear. Only digital currencies that have defined business models and clear utility within mainstream society will survive a crash.

Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data.

We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes.

Bitcoin crashing. Moves down over $10, on the day

Your Money. Personal Finance. Your Practice. Popular Courses. News Company News. Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Bitcoin Bitcoin's Price History. Bitcoin Is Bitcoin Useless?

I will also detail what I expect is the net result of all of this recent news and let you know what I think is coming next for bitcoin and cryptocurrencies. On the surface, not a good thing at all!

Falling volume

In normal markets you would put this down to a sudden loss of confidence, but in crypto things are a little different. A combination of these 2 things is what makes bitcoin insanely volatile. As the world slowly adopts bitcoin, the amount of individuals holding large amounts of Bitcoin reduces as they sell to take perceived profit into FIAT currency or perhaps they realise their profit in a different cryptocurrency. When these large holding individuals sell Bitcoin it can trigger a loss of confidence among the community so you end up with a cascading sell-off.

However that is not what happened here.

Cryptocurrency bubble

F2Pool Bitcoin mining pool sent Bitcoin in a single transaction out of their bitcoin mining wallet and right onto the exchanges. They then proceeded to dump all of this bitcoin in a very short period of time. It is unknown if F2pool were also shorting Bitcoin to capitalise on the price falling. As the price of Bitcoin fell, there are so many new people in the market and new money is easily panicked so they then start selling for a loss and so you end up with huge amounts of Bitcoin flooding towards exchanges.

This then snowballs into a catastrophic market move triggered by just one Bitcoin miner.